This comprehensive guide delves into Dholera Special Investment Region (SIR), India’s pioneering greenfield smart city, offering investors a detailed understanding of its vision, infrastructure, investment opportunities, and crucial considerations for maximizing returns.

Executive Summary: Why Dholera is on Every Smart Investor’s Radar

Dholera Smart City represents a monumental leap in India’s urban development, envisioned as a global manufacturing and trading hub. It stands out as India’s first greenfield industrial smart city, meticulously planned from the ground up to offer world-class infrastructure and a conducive environment for both businesses and residents.

This is not merely a local development; it is a national strategic initiative aimed at economic resurgence, deeply integrated into the Delhi Mumbai Industrial Corridor . The sheer scale of the project, projected to be twice the size of Delhi and six times that of Shanghai, underscores a long-term, high-impact vision for industrial and economic growth

For investors, Dholera offers a unique blend of government backing, strategic location, and significant long-term appreciation potential, positioning it as a compelling, albeit patient, investment destination. The designation as India’s first greenfield smart city implies a unique opportunity, as it allows for comprehensive, integrated planning from its inception, unlike brownfield developments.

This translates directly into benefits such as “plug-and-play” infrastructure, streamlined “single-window clearances,” and the prestigious status of a “platinum-rated green city”. For businesses, this means reduced operational friction and a higher quality of life for the future workforce, which are critical for long-term sustainability and talent attraction. Securing prime locations within this meticulously designed, future-proof ecosystem before it reaches full maturity presents a significant advantage

Dholera Smart City: Vision, Development, and Government Backing

Dholera Smart City is not merely a real estate project; it is a strategic national initiative designed to be a blueprint for future urban development in India. Its genesis lies within the broader framework of the Delhi-Mumbai Industrial Corridor (DMIC) and the Indian government’s Smart Cities Mission.

The Genesis: Part of a Larger Economic Corridor

Dholera Special Investment Region (SIR) is a greenfield industrial planned city located approximately 100 km southwest of Ahmedabad, Gujarat. It is a key component of the Delhi-Mumbai Industrial Corridor (DMIC), a joint initiative by the Government of India and Japan, aiming to create a global manufacturing and trading hub.

The project was initially conceived by Narendra Modi when he was the Chief Minister of Gujarat, highlighting its long-standing political commitment and vision.

This foundational alignment with national economic objectives positions Dholera as a cornerstone of India’s industrial future.

Robust Government Support: A Foundation of Trust

Dholera operates under the Gujarat Special Investment Region (SIR) Act 2009, which provides a comprehensive legal framework for its development and management. A Special Purpose Vehicle (SPV) named Dholera Industrial City Development Limited (DICDL) has been formed as a joint venture between the Central Government (49% through NICDC Trust) and the Gujarat State Government (51% through DSIRDA) to execute the project.

This joint ownership underscores strong government commitment and significantly reduces investment risk, as it signals stability and regulatory predictability. The direct involvement of both central and state governments, coupled with substantial initial funding of Rs. 3,000 crore, indicates a deliberate strategy to create a secure investment environment, mitigating political and bureaucratic hurdles often associated with large-scale developments in India

Furthermore, the city actively promotes FDI-friendly policies, offers attractive tax incentives, and provides “plug-and-play” industrial zones with ready-to-use infrastructure to attract businesses. This comprehensive support system is crucial for attracting large-scale, long-term capital, as it signals a commitment to project completion and a conducive business environment

Phased Development: A Structured Growth Trajectory

The entire Dholera SIR spans approximately 920 sq km and is being developed in three distinct phases, further broken down into six Town Planning (TP) Schemes. This phased approach is not merely a logistical necessity but a strategic tool for value creation and managing risk.

- Phase 1 (2020-2025): This initial phase focuses on the “Activation Area,” a priority development zone covering 22.5 sq km (5600 acres) within Town Planning Schemes TP1 and TP2. Core infrastructure within this area is largely developed and operational, demonstrating tangible progress and building investor confidence.

- Phase 2 (2025-2035): This phase involves expansion across more than 100 sq km, scaling up industrial, commercial, and residential zones, and integrating additional DMIC projects and Special Economic Zones (SEZs).

- Phase 3 (2035-2040+): The final phase envisions the full development of the entire 920 sq km area into a complete smart city ecosystem.

This structured, phased development allows for controlled growth, ensuring that infrastructure keeps pace with demand. It provides clear milestones for investors, enabling early entrants to benefit from lower price points while later phases capitalize on established infrastructure and increased demand, driving further appreciation.

This controlled release of value manages both risk and expectation, ensuring that investment is tied to concrete development milestones rather than pure speculation. It also offers flexibility for investors to choose their entry point based on their risk appetite and holding period.

Unparalleled Infrastructure & Connectivity: The Pillars of Growth

Dholera’s ambitious vision is underpinned by a robust and futuristic infrastructure network designed to support a thriving industrial and urban ecosystem.

This connectivity is a primary driver of its investment appeal. The comprehensive infrastructure development is not just about facilitating movement; it is designed to support a diverse range of industries, building a more resilient and diversified economic base.

For instance, the Dedicated Freight Corridor and seaport facilitate logistics and manufacturing, while the solar park attracts renewable energy companies, avoiding over-reliance on a single sector.

Mega Connectivity Projects: Seamless Access to Markets

- Ahmedabad-Dholera Expressway: A 109-km, six-lane access-controlled expressway, with provisions to expand up to 10 lanes, is nearing completion and is expected to be operational by 2025. This vital link will drastically reduce travel time to Ahmedabad to under one hour, significantly boosting connectivity for logistics and commuting.

- Dholera International Airport: A greenfield airport project near Navagam is under construction, with Phase 1 anticipated to be operational by 2026. It is designed to handle 3 million passengers annually in its initial phase, eventually expanding to 50 million passengers per annum. This will significantly enhance global and domestic connectivity for both cargo and passengers, attracting a diverse range of businesses.

- Metro Rail: A metro line is planned to connect Dholera to Ahmedabad and Gandhinagar, which will greatly improve intra-city and regional transit, thereby boosting residential demand and overall accessibility.

- Dedicated Freight Corridor (DFC): Dholera’s strategic proximity to the DMIC corridor and proposed freight rail links (such as from Bhimnath to Dholera) will enhance supply chain efficiency and logistics, a critical factor for industrial operations.

- Seaport: Being surrounded by water on three sides—the Gulf of Khambhat to the east, Bavaliari creek to the north, and Sonaria creek to the south—Dholera is strategically positioned for a major seaport, with over 2,000 hectares of land already allocated for its development

Smart Utilities & Urban Planning: A Future-Ready City

Beyond physical infrastructure, Dholera’s emphasis on “smart” utilities, digital connectivity, and integrated city management is a critical differentiator. This focus on “ease of living” and “smart governance” is vital for attracting and retaining skilled talent and businesses in the long run, making it a more attractive investment destination compared to traditional industrial zones.

- Solar Power Park: An Ultra-Mega Solar Park with a planned capacity of 5000 MW is a cornerstone of Dholera’s sustainable development. Phase 1 (1000 MW) is already under implementation, with 300 MW having been commissioned by Tata Power. This commitment to renewable energy aligns with its “Platinum-rated green city” status, enhancing its eco-friendly image.

- Advanced Water Management: The city incorporates advanced water management systems, including a 24×7 water supply with IoT-based monitoring, as well as sophisticated sewage and water recycling systems.

- ICT Network: Dholera boasts a robust Information and Communication Technology (ICT) network, featuring high-speed internet, IoT-enabled infrastructure, smart grids, and an integrated city management system. The Administrative and Business Centre of Dholera (ABCD Building) serves as the central command and control hub, symbolizing the city’s operational readiness.

- Plug-and-Play Industrial Zones: These zones offer ready-to-use infrastructure at the plot level, including all necessary utility connections, significantly facilitating the ease of doing business for industries.

- Green Cover: The urban planning includes extensive green cover, with neighborhood parks within 400m and community parks within 800m of residential areas, promoting a high quality of life.

| Infrastructure Project | Status/Expected Completion | Key Impact for Investors |

|---|---|---|

| Ahmedabad-Dholera Expressway | 95% complete, operational by 2025 | Reduces travel time to Ahmedabad to <1 hr, boosting connectivity for logistics & commuting. |

| Dholera International Airport | Under construction, Phase 1 operational by 2026 | Enhances global and domestic connectivity for cargo and passengers, attracting businesses. |

| Metro Rail (Ahmedabad-Dholera) | Planned, under feasibility study | Improves intra-city and regional transit, boosting residential demand and accessibility. |

| Dedicated Freight Corridor (DFC) | Proximity and planned links | Streamlines logistics and supply chain efficiency for industrial operations. |

| 5000 MW Solar Park | Phase 1 (1000 MW) under implementation (300 MW commissioned) | Provides sustainable and reliable power, attracting green industries and enhancing city’s eco-friendly image. |

| ABCD Building (Command & Control) | Operational (first completed structure) | Symbolizes operational readiness, ensures smart governance and efficient urban services. |

Investment Landscape: Opportunities Across Residential, Commercial, and Industrial Sectors

Dholera’s master plan allocates specific zones for various land uses, creating distinct investment opportunities tailored to different investor objectives and risk appetites. A symbiotic relationship exists between industrial, commercial, and residential growth within Dholera. Major industrial investments directly lead to job creation, which in turn drives demand for residential plots for the workforce and commercial spaces for supporting services. This is not isolated sector growth but a planned, integrated ecosystem where each component fuels the others, creating a more robust and sustainable investment environment.

Residential Land: Building Future Communities

Investing in raw land in Dholera offers greater flexibility in construction style, a lower initial investment, and potentially higher resale value compared to already built properties. This makes it a cost-effective entry point into a rapidly developing smart city.

As industries and IT parks establish themselves, job opportunities are projected to surge, leading to increased demand for residential zones. For example, Tata’s plan to build over 500 homes and 1,500 housing units for its semiconductor plant employees directly illustrates this anticipated demand.

The Floor Space Index (FSI) rules are critical for residential investors. The base FSI in most residential zones is 1.8, meaning a built-up area 1.8 times the plot area is allowed. Investors have the option to purchase additional FSI for certain zones to maximize construction potential, directly impacting property utilization and potential returns. Compared to metro cities, Dholera offers residential plots at more affordable rates, making it particularly attractive for middle-class and first-time investors.

Commercial Land: Hubs for Business and Services

Dholera’s strategic positioning and infrastructure development make it a prime location for commercial ventures. Key commercial investment areas include the Activation Area (Town Planning Scheme TP2A, TP4A), Linear Development (property near the 250m express highway & 55m internal road), and the Central Business District (CBD). Commercial zones generally benefit from a higher FSI, often ranging from 2 to 3, allowing for larger office complexes, retail malls, and hospitality services.

This higher FSI, coupled with the option to purchase additional FSI, serves as a significant value maximization tool, allowing developers to increase built-up area and thus enhance revenue potential from sales or rentals.

Dholera is poised to attract a diverse range of businesses, including IT and business parks, retail establishments, showrooms, corporate offices, and hospitality services. The allocation of a plot for the city’s first 5-star hotel further underscores this commercial potential.

Industrial Land: Manufacturing and Logistics Powerhouse

Dholera is specifically designed to host non-polluting industries, with a strong focus on sectors such as defense manufacturing, heavy engineering, auto & auto ancillaries, pharmaceuticals, electronics, renewable energy, and agro & food processing. Industries locating in Dholera benefit from significant government incentives, including single-window clearances, tax benefits, and subsidies, particularly for manufacturing, electronics, and renewable energy sectors.

The presence of major industrial players validates Dholera’s potential. Notable investments include Tata Electronics establishing a ₹91,000 crore semiconductor plant, and Vedanta Group’s proposed $5 billion investment. Dholera’s proximity to ports and airports, coupled with the Dedicated Freight Corridor, makes it an ideal location for logistics and warehousing parks. The availability of large, contiguous land parcels with clear titles, ranging from 1 acre to 330 acres, further makes it suitable for establishing large manufacturing units.

| Land Type | Key Benefits for Investors | FSI (Floor Space Index) | Specific Considerations |

|---|---|---|---|

| Residential | Lower initial investment, flexibility in construction, high resale value, future demand from job creation. | Base 1.8; additional FSI purchasable. | Ideal for long-term hold (10+ years), patience required for amenities development. |

| Commercial | Strategic locations for business hubs, high appreciation potential from economic growth. | Higher, typically 2-3. | Suitable for retail, offices, hospitality, and service-oriented businesses. |

| Industrial | Government incentives, plug-and-play infrastructure, major corporate investments, logistics advantage. | Varies by zone, typically higher for industrial use. | Focus on manufacturing, EV, renewable energy, logistics. Large land parcels available. |

ROI Analysis & Price Trends: Unlocking Dholera’s Appreciation Potential

Dholera’s real estate market has shown remarkable growth, driven by ongoing infrastructure development and increasing investor confidence, presenting significant appreciation potential. The visible progress in construction and development in the region has demonstrably improved investor confidence, which is directly reflected in the upward shift in land prices. This establishes a positive feedback loop: tangible advancements validate the government’s vision, boosting investor trust, and leading to increased demand and price appreciation. This self-reinforcing mechanism is a critical driver of Dholera’s return on investment.

Historical Land Price Appreciation: A Track Record of Growth

Dholera SIR has witnessed a massive rise in land prices, with some areas experiencing a tenfold increase in the last decade. Prices in certain Town Planning (TP) Schemes have surged from INR 700 per square yard to between INR 7,000 and INR 10,000 per square yard. Other TP schemes have seen prices increase to between INR 3,000 and INR 7,000 per square yard.

Industrial land prices, in particular, have seen substantial jumps: from ₹500–₹1000 per sq. yard in 2015-2020, they rose to ₹1000–₹2000 per sq. yard in 2021-2024. Currently, prime lands near the airport and expressway are selling for ₹3000–₹5000 per sq. yard.

Overall land price appreciation in Dholera has been noted at 4x–6x in the last five years. Residential plots, specifically, saw prices jump threefold between November 2022 and March 2024.

Projected Growth: Expert Predictions for Future Value

Experts predict a consistent 15-20% annual appreciation in land values, especially as the airport, semiconductor plant, and expressway become fully operational. By 2030, Dholera is expected to become India’s largest greenfield smart city, attracting over ₹1 lakh crore in industrial investments and generating more than 8 lakh jobs. This significant economic activity is anticipated to further increase demand across all land types. Long-term return on investment is expected to be substantial for patient investors.

Case Studies: Tangible Investor Returns

Concrete examples highlight the strong returns already realized in Dholera. Early investors who acquired industrial land between 2015 and 2020 at approximately ₹1,000 per square yard have observed its value increase by 7-10 times. More recent buyers, investing between 2021 and 2024, have experienced 100-150% returns in just 3-4 years.

Long-Term vs. Short-Term Investment Horizon: Setting Realistic Expectations

Dholera is primarily a long-term investment, typically requiring a holding period of 10 years or more, owing to its greenfield status and ongoing development. While significant appreciation is projected, liquidity risk exists in the early phases, meaning reselling land quickly might be challenging. Investors should be prepared to hold their investments for years to realize full potential.

The significant government backing and phased development of Dholera act as a de-risking mechanism for the long-term investor. The government’s consistent investment and policy support, including single-window clearances and tax benefits, reduce the probability of project abandonment or significant delays. This safeguards the long-term appreciation potential, making the substantial return on investment more plausible for those with a patient investment horizon.

| Period | Industrial Land Price (per sq. yard) | General Land Price (per sq. yard) | Appreciation Drivers |

|---|---|---|---|

| 2015-2020 | ₹500–₹1000 | ₹700 (some TP schemes) | Initial planning, DMIC announcement, early government commitment. |

| 2021-2024 | ₹1000–₹2000 | ₹3,000–₹7,000 (some TP schemes) | Infrastructure progress (expressway, airport construction), increased investor confidence. |

| 2025 (Current) | ₹3000–₹5000 (prime lands) | ₹7,000–₹10,000 (some TP schemes) | Visible development, major corporate investments (Tata Electronics), nearing infrastructure completion. |

| 2026-2030 (Projected) | 15-20% annual appreciation | Exponential growth potential | Airport & semiconductor plant fully operational, expressway completion, 8 lakh+ jobs, global manufacturing hub status. |

Navigating Your Investment: Legalities, Due Diligence, and Risk Mitigation

Investing in a greenfield smart city like Dholera requires meticulous due diligence to ensure a secure and profitable venture. Understanding the legal framework and potential risks is paramount.

Essential Legal Checks: Ensuring a Secure Investment

To ensure a secure investment, several legal checks are crucial. It is imperative that the land or plot possesses a clean title, free of any outstanding loans, disputes, or other obligations. Verification that the land is approved for its intended usage—whether residential, commercial, or industrial—through Non-Agricultural (NA) approval is also essential. Furthermore, the project should be registered under the Real Estate Regulatory Authority (RERA) to ensure legitimacy and adherence to legal standards, a point of particular importance for Non-Resident Indians (NRIs).

Confirmation of the Floor Space Index (FSI) details with local authorities or the developer is critical, as FSI directly impacts the permissible construction volume on the land. Obtaining an Encumbrance Certificate (EC) is advised to confirm that the property is not mortgaged or burdened by any pending financial liabilities. Finally, familiarity with the official land allotment policy is necessary, especially for bulk or industrial land, as it outlines pricing, lease terms (e.g., 99-year leasehold), and operational guidelines.

The emphasis on clean titles, RERA compliance, and an online pre-registration process via the GARVI portal signifies a deliberate move towards greater transparency and reduced bureaucratic friction, which is a significant de-risking factor in the Indian real estate market.

The Purchase Process: A Step-by-Step Guide

The Government of Gujarat has introduced an online portal, the GARVI portal, to streamline the property registration process for buyers, facilitating e-payment of stamp duty and registration fees. The process typically involves selecting and booking a plot, often through the developer’s online facilities, by paying a booking amount (typically 5-10% of the plot price). Subsequently, necessary documents, including identity proof, address proof, photographs, and the sale agreement, must be gathered and verified. Engaging a lawyer at this stage is strongly recommended.

After online submission, an appointment is scheduled at the Sub-Registrar’s Office for biometric verification and final document signing.

This legal process includes paying stamp duty (4-6% of property value) and registration fees (around 1%). The final step involves the mutation of property records to reflect the new ownership.

Common Pitfalls to Avoid: Learning from Others’ Mistakes

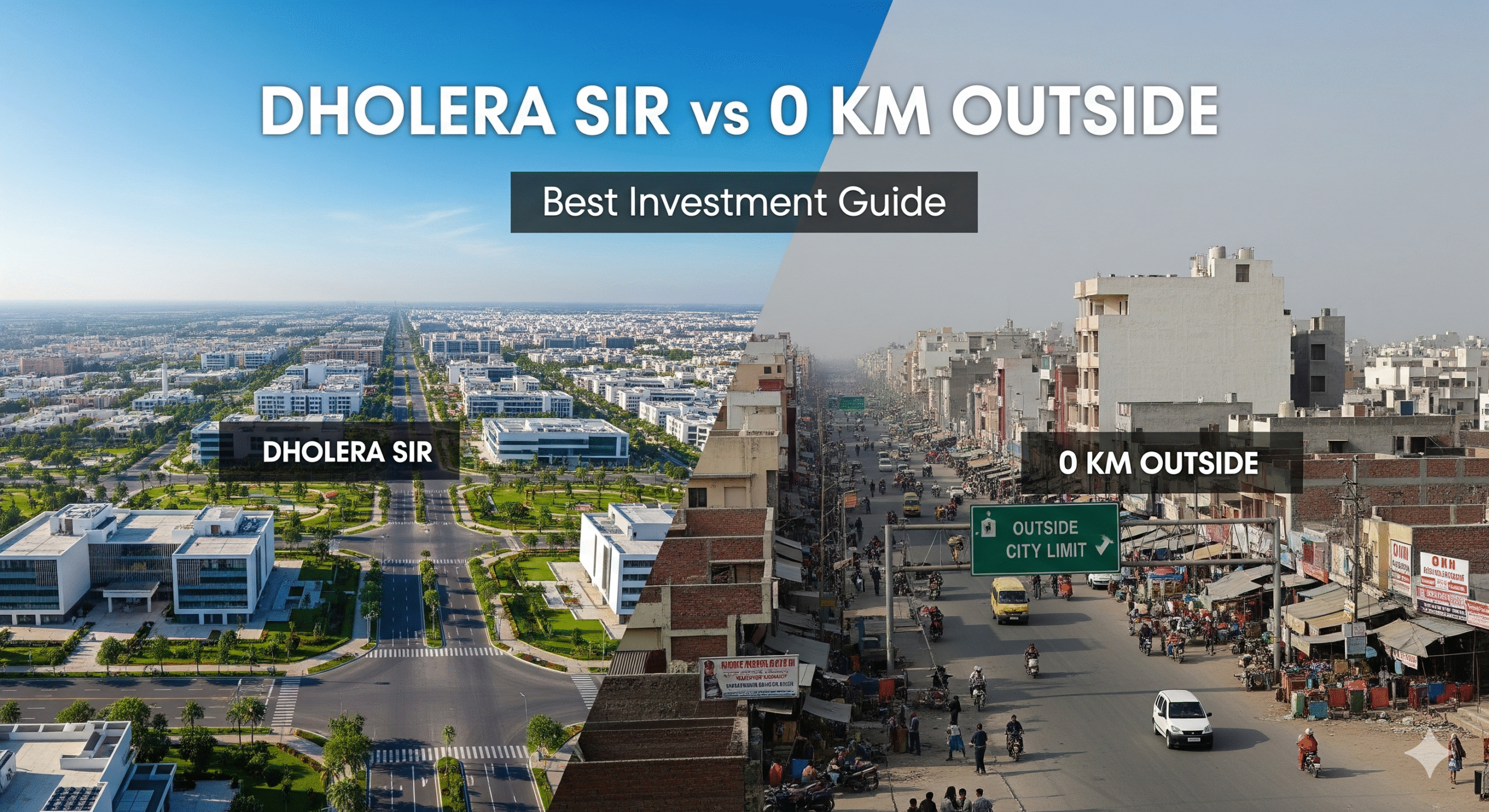

Several common pitfalls can undermine an investment in Dholera. Skipping due diligence is a critical error; payments should never be made without thorough legal verification of the property’s status. Investing in non-approved projects is another significant risk; it is crucial to ensure that the development project has all necessary approvals from local authorities and is part of the officially sanctioned Town Planning Schemes (TP1, TP2, etc.).

Projects located outside the Dholera SIR boundary or official TP schemes may not benefit from government amenities or future appreciation.

Misunderstanding FSI can limit construction potential and negatively impact profitability. Lastly, always buy from reputed developers and verify their RERA number and track record to avoid unverified sellers.

Risks and Considerations: A Realistic Outlook

While Dholera presents immense potential, it is essential to maintain a realistic outlook regarding inherent risks. The project, despite rapid progress, is still under construction, with full development projected by 2042 or later. Investors must exercise patience.

Liquidity risk is present in the early phases; due to the ongoing development, reselling land quickly might be challenging, positioning it as a long-term investment rather than a short-term gain.

Furthermore, basic amenities such as schools, hospitals, and markets are currently limited, and buyers should anticipate waiting for the full social infrastructure to develop.

The repeated emphasis on delayed development, liquidity risk, and limited current amenities serves as an implicit filter for the type of investor Dholera is designed for.

This model actively discourages short-term speculators and instead attracts long-term visionaries and those patient enough for a decade-long or longer investment horizon.

This self-selection of patient capital contributes to market stability by reducing speculative bubbles and ensures that investment aligns with the project’s multi-decade development timeline, ultimately benefiting the long-term health and appreciation of the region.

Making an Informed Decision: Expert Recommendations for Investors

With Dholera’s immense potential comes the responsibility of making informed, strategic investment choices. Expert guidance and thorough due diligence are paramount.

Tips for Selecting the Right Plot and Developer

Thorough research into the best areas for investment is crucial. Focus on the Activation Area (TP2A, TP4A) and Linear Development zones, which are expected to demonstrate higher appreciation. For industrial land, prime locations include areas near the Dholera International Airport, the Ahmedabad-Dholera Expressway, and Gujarat Industrial Development Corporation (GIDC) zones. It is imperative to verify that the chosen plot is part of an approved Town Planning Scheme (TP1, TP2, etc.) and is appropriately zoned for the intended use.

Selecting a reputable developer is non-negotiable. Opt for developers with a proven track record, RERA registration, and properties with clear titles. Caution is advised against projects located outside the official SIR boundary, as these may not benefit from government amenities or appreciation.

Finally, consider future development plans; investing in areas near upcoming infrastructure such as metro stations, industrial parks, or designated green spaces typically offers higher growth potential.

Importance of Site Visits and Expert Consultation

Always conduct a physical site visit to verify the property. Brochures may present an idealized image, and an on-ground assessment is vital for an accurate understanding. Many developers offer free site visits to facilitate this crucial step.

Furthermore, engaging with legal and real estate advisors is highly recommended. These professionals, knowledgeable about Dholera’s specific FSI rules, land acquisition processes, and legal requirements, can provide invaluable guidance in selecting the right plot, verifying documents, and maximizing returns. The emergence of a specialized advisory ecosystem around Dholera, with “authorized advisors,” “investment guardians,” and experts in real estate and revenue laws, indicates a maturing market where complexities necessitate expert guidance. This availability of reliable information and support further reduces the investment process for new entrants.

Strategic Investment Approaches for Different Investor Profiles

Dholera is particularly well-suited for long-term investors with a horizon of 10 years or more, who seek significant capital appreciation and are prepared to navigate early development volatility. This category includes land bankers, industrialists, and large corporations. The consistent advice to hold investments for years, and the potential for substantial returns if patient, highlights a core principle of greenfield investment.

The value accrual in Dholera is directly tied to the completion of its long-term infrastructure and industrialization plans, implying that the ‘time’ component of the investment is not just a holding period but an active ‘profit multiplier.’

The longer an investor holds, the more the underlying value of the city’s development translates into tangible returns. This reinforces that Dholera is for strategic, patient capital, not speculative gains.

Conclusion

Dholera Smart City stands as a testament to India’s ambitious urban development vision, offering a unique and compelling investment proposition. Its strategic location within the Delhi-Mumbai Industrial Corridor, coupled with robust government backing, world-class infrastructure, and a meticulously planned phased development, positions it as a future global manufacturing and trading powerhouse.

While Dholera is a long-term investment that requires patience, the historical appreciation and projected growth figures underscore its significant potential for high returns. The transparent legal framework and the emerging ecosystem of expert advisors further mitigate risks, making it an attractive destination for discerning individual and institutional investors, including NRIs.

For those with a long-term vision and an appetite for substantial capital appreciation, Dholera represents not just a real estate investment, but an opportunity to be part of India’s next economic growth story. Investing in Dholera today means securing a stake in a future-ready city designed for sustainable growth and prosperity.